Understanding Decentralized Finance [DeFi] As A Beginner.

Hello Crypto Amigo,

Are you new to Decentralized Finance and don’t know where exactly to start? Or maybe you probably want to up your game and take your DeFi knowledge to the next level.

No matter where you are in your DeFi journey, this guide is for you. In this guide and other articles after it, I will properly break down everything about DeFi in the simplest form for you.

Blockchain and cryptocurrencies have astronomically exploded into a trillion-dollar industry today, sparking a new wave of worldwide financial disruption. Developments occur quickly in the crypto space, and decentralized finance (DeFi) is a current trend.

"It's an amazing and electrifying space to be, undeniably. If you're still unaware or unsure of what the whole DeFi fuzz is all about, let’s dig a little deeper to learn more about it."

Let's start by understanding Decentralized Finance [DeFi]

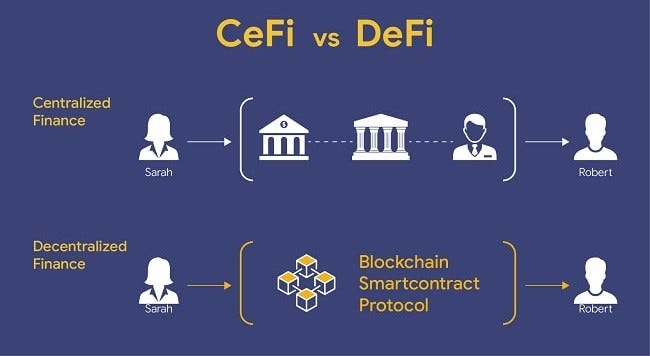

To really understand decentralized finance, how it works, and why it is important; it would be great to know how Decentralized Finance differs from Centralized Finance [CeFi].

What is Centralized Finance?

Before the introduction of DeFi, centralized finance was originally the standard for crypto trading as it occupied a stronghold over the crypto industry. With centralized Finance [CeFi], money and digital assets are held by banks and financial systems that aid money movement with charge fees between different parties.

"For example, Let's say you purchase a new pair of sneakers and make the payments using your funded credit card, the charge fees associated with that purchase go to these financial systems.”

In crypto, all trade and exchanges are handled through a central exchange, and funds are managed by specific personnel overseeing activities on the central exchange. It generally means that you don’t own a private key that provides you access to your wallet.

Now that you understand the concept of Centralized Finance [CeFi] in normal terms and in the world of crypto, let’s find out what Decentralized Finance [DeFi] really means.

What is Decentralized Finance [DeFi]

Decentralized finance uses technology that terminates the use of intermediaries, allowing traders or businesses to conduct financial transactions through emerging technologies. DeFi can generally be described as an umbrella term for financial applications built on blockchain technology with the use of smart contracts which enables digital transactions between multiple parties.

DeFi broadly consists of applications and peer-to-peer protocols developed on decentralized blockchain networks enabling easy lending, borrowing, or trading of financial tools. DeFi aims to build an open-source, permissionless, and transparent financial service ecosystem that is not governed by any central authority and allows users full access to their assets.

"This means you can lend, borrow, and trade using software that records and verifies financial actions in distributed financial databases over an internet connection from anywhere.”

How is DeFi different from CeFi?

There are many notable differences you can find between DeFi and CeFi, but it all boils down to which of these technologies the users trust to be more secure and beneficial. Both DeFi and CeFi deliver a wide range of cryptocurrency-related financial services. Let’s discuss some of the features and functionalities that make them different.

Features of Centralized Finance (CeFi)

Centralized Exchange (CEX): Although funds are basically stored on the exchange, they are kept off users custody and are vulnerable to threats in case of security measures. centralized exchanges have been the target of various security attacks.

Fiat Conversion Flexibility: Centralized financial services tend to offer a lot more flexibility than decentralized services when turning fiat to cryptocurrency and vice versa.

Cross-chain services: Centralized financial services support the trading of LTC, XRP, BTC, and many other coins issued on different blockchain platforms.

Features of Decentralized Finance (DeFi)

Permissionless: There are no requirements or need to complete a KYC to access the DeFi services. You can directly access the services using a wallet or providing personal information or depositing money with DeFi.

Trustless: The most significant benefit of using DeFi services is that you don’t need to trust that the service will perform as promoted. It is transparent and everyone involved can view the transactions happening on the application network.

Quick Innovation: One of the greatest advantages of DeFi is its quick rate of innovation. Decentralized finance is still in the beginning stages of its evolution, constantly building and experimenting with new capabilities.

“DeFi creates a fair and transparent financial system where anyone can participate as it allows unbanked people to access financial and banking services via blockchain technology.”

DeFi Protocols and How They Work

Most DeFi applications otherwise referred to as Dapps, are built using the Ethereum network, and have grown into a complete ecosystem of working applications and protocols that deliver value to various users. Explore DeFi Apps here.

1. DeFi Lending and Borrowing:

Decentralized Finance has re-modernized finance services by enabling lending and borrowing. Decentralized lending and borrowing have offered crypto holders lending opportunities to gain annual yields and individuals to borrow money at a specific interest rate.

2. Decentralized Exchanges:

Decentralized Exchanges (DEx) are undeniably one of the key functions of DeFi, with the maximum amount of capital locked compared to other DeFi protocols. DExs allows users to exchange or swap tokens with other assets, without a centralized intermediary or custodian.

3. Prediction markets:

Predictions markets are platforms where individuals can make predictions on the realization of future events, ranging from sports bettings or politics to predictions on stock prices and more. DeFi opens these markets for participation.

“The goal of DeFi is to simply get rid of the third parties that are involved in all financial transactions, making it more transparent.”

Conclusion

Both Decentralized Finance and Centralized Finance aim to achieve similar goals. They plan to make crypto trading popular and improve the trading volume. However, the way these two ecosystems carry out their objectives is different.

For the first time in history, a global financial system for a worldwide population is being shaped by that very population. Everyone can take part in the governance of DeFi protocols and get a seat at the table where the world of decentralized finance is actively created.